Academia2.0 Could Look More Like Startups

We must deploy capital to maintain growth in frontier fields like biotechnology. A fund-of-funds investing approach from the US Government could spur organic growth in targeted areas.

Author’s note: This is one of those essays that starts simple and ends up big. If you make it all the way through, here are the three ideas and the conclusion: (1) Private groups like domain-specific venture capitalists and non-profit scientific organizations, which I collectively call fieldbuilders, are the best model we have for spurring innovation ecosystems filled with empowered, collaborative teams. (2) There is a widening hole in the status quo. Universities are weakening rapidly and government models for advanced research were developed in the 50s in a radically different economic public/private balance. So it’s essential to prototype scalable models for future talent development and research. (3) The unit of team research, if not done in a university or a startup, requires a repeatable structure to accept and deploy capital. Together, I argue that the government could use a fund-of-funds approach to fund the fieldbuilders to fund —and cultivate— the teams doing cutting-edge research.

Enjoy and I look forward to discussions. -Dan

How do you price something that has little value today, but immense value in the future? -Cooper Rinzler

During the 1930s, while most leaders were hunkering down for the Great Depression, William McKnight went on a hiring spree. McKnight was the President of Minnesota Mining and Manufacturing (3M), and in this era 3M ventured beyond its traditional work in sandpaper and abrasives. They achieved notable blockbusters like Scotchlite Reflective Sheeting (still used on traffic signs today) and Scotch Tape in its iconic “snail” dispenser (still on my desk today). When the economy did improve, 3M was filled with talent to capitalize on the upswing. For this exceptional leadership, McKnight is often referenced in business education as a gold-standard for taking a functionally optimistic longview in the face of a macro-scale downturn.

If McKnight were alive today, he would say we must invest through the market dip in biotechnology. My unofficial guess is that Ginkgo lets go of 25-50% and once-shiny startups like Cemvita who fail to raise their Series B1 need to layoff the majority of their teams. Amyris went bankrupt last year, most (all?) SynBio SPACs are down 80-99% and the Fierce Biotech Layoff Tracker has had a busy 2024. Outside of pharma and agriculture, biotechnology struggles to match its immense potential of a platform for atomically precise and infinitely scalable technologies to short-term funding options.

So I propose we make a USA Applied Research Acceleration Fund (ARAF). This is not a new institution but a monetary vehicle akin to a fund-of-funds available to citizens who are already doing the relevant work of cultivating teams and scientific progress. It’s to combine the U.S. government’s excellence at convening resources with the civilian ecosystem’s advantages of speed and autonomy. While anybody could apply to deploy funds from an ARAF, I imagine Venture Capitalists (VCs) and domain-specific research non-profits (aka, fieldbuilders like Homeworld Collective) would be most competitive and aligned. In practice, an ARAF would look something like:

Pick the problems: Use the convening power of the Government to agree on a few frontier-level challenges (eg: gigaton-scale carbon capture, brownfield metal mining, quantum engineering) that are bottlenecked by science risk. Critically, use thought leadership to cut through a vague theme into specific problems that need to be solved.

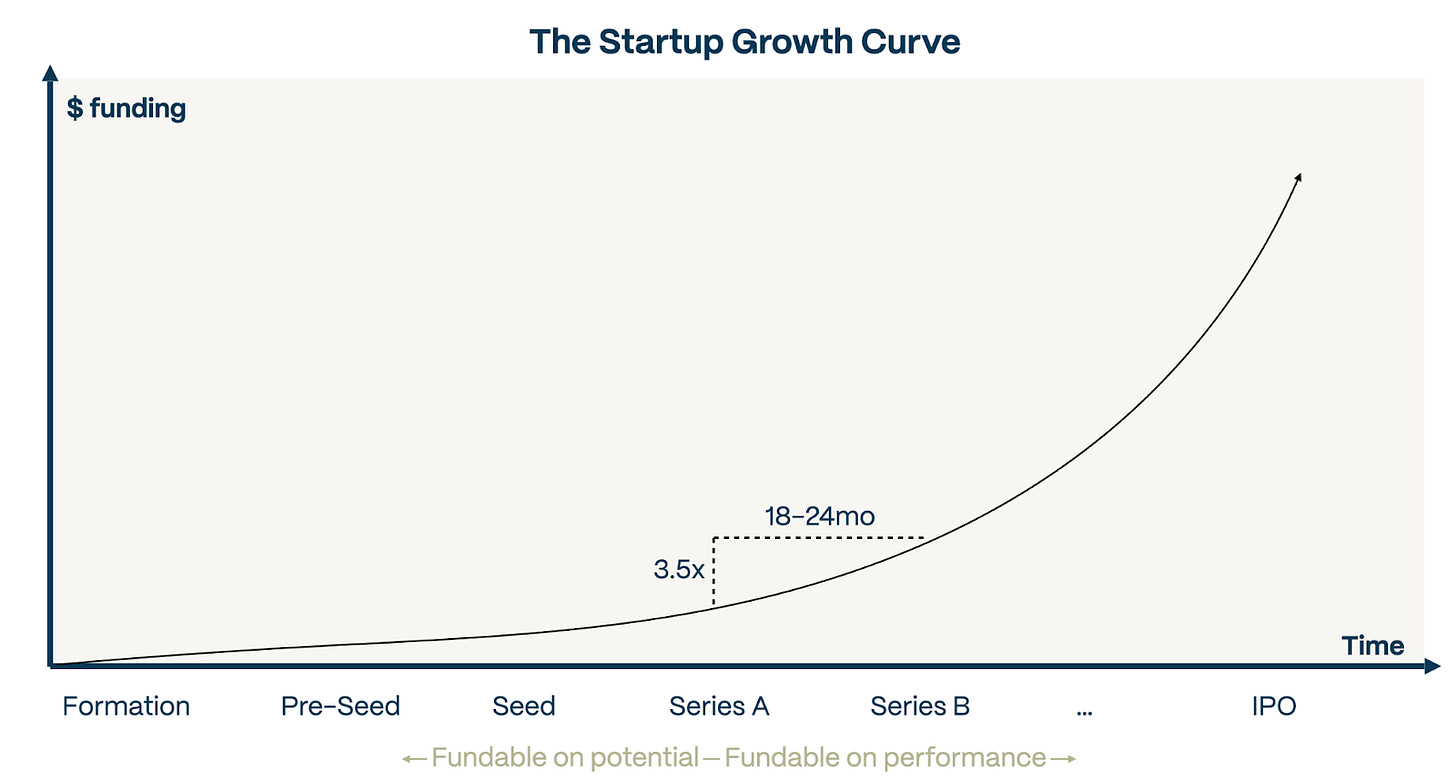

Institutionalize the new growth curve: Create a new growth curve for problem-focused ventures (profit or non-profit) that charge right into science risk. I will argue the right growth curve is a sigmoid, as opposed to the standard exponential curve that all startups implicitly utilize.

Open the competition for the funds: Funders with domain expertise will compete to manage this capital. These funds will accept the standard 2% management fee but shall only be used for underwriting science risk.

Let professionals deploy the grants: The funds will diligence the team and the potential impact of the technology if it works. Taxpayers and ARAF Leadership can monitor performance using the standard venture capital LP accountability structure with memo writing,

“ARAF” is a terrible name. ARAF a clear placeholder to remind us that these are ideas in motion. That said, I’m beginning to see what the ideal next iteration of western academia, and its relation to science and industry, needs to be.

Four foundations for the ARAF argument in the context of biotechnology

Because I have seen some fields work very well and some fields function poorly, I look at the progress of scientific fields as something that can be engineered (see: “What are the most productive communities?”). There is a four-part groundwork to the eventual solution of an ARAF.

Major layoffs are blowing a hole in the Synthetic Biology field: The public companies with “Synthetic Biology” branding are down in a big way: LanzaTech stock is down 80%, Ginkgo/Zymergen down 97%, Berkeley Lights down 95%. In the private markets, startups like MicroByre and Scifi Foods shut down. While the best of this vintage of companies are continuing to fundraise and grow, there is now more talent than open roles. In conversation with Matias Kaplan looking at the FierceBiotech Layoff Tracker, we roughly estimate 5,000 jobs have already been cut and I wouldn’t be surprised if there were another 5,000-10,000 layoffs on the horizon. Depending on how you do the math of PhD-level biotechnologists doing things other than drug development or corn optimization, this might be 25-50% of the US SynBio workforce.

Biotechnology is a critical pillar of future technology. Maintaining American leadership at the cutting edge of biotechnology is of national importance. With the surplus of bioengineering talent, we don’t have an elastic structure that can continue to deploy and develop biotech talent. Think of the loss if McKnight’s 3M had let their chemical engineers turn into subsistence farmers. There may also be a negative present-day case study: The failure to invest in long-term workforce is playing out in the nuclear sector as it scrambles for a shortage of trained staff.

Government funding is critical for innovation yet cannot scale wide nor small nor fast: Less than 17% of the CHIPS/IRA was deployed, and will bias towards single large lump sums (Politico, May 2024). There are many fantastic, mission-driven people working inside the government to make it support innovation better, but there are simply not enough empowered individuals with discretionary budgets. This leads to science-by-committee, which leads to a bias to bulky grants rather than nimble funding (see Derek Thompson’s America Needs a New Scientific Revolution). To give a sense of current scale, the Department of Energy makes ~2000 contracts a year for $42B and ~900 grants a year for a total of $2B with roughly 2,300 staff. Universities have been the primary recipient of this funding, but I think that this is changing. The rapid growth and experimentation of independent research institutes show increasing capability to fund the problem-focused teams directly, without a big intermediate like a university, which is both faster and more efficient.

Every good deeptech VC has its own hack for working with non-dilutive funds. While most investors ride (mooch) on trends, some VCs actually create movements (eg: Founder-Led Bio). When done correctly, great investors create a virtuous cycle of talent creation reinforcing value creation. This work creates natural collaboration points between VCs and grantmaking organizations, but everyone does it a different way. Back in my design days at IDEO, “look for hacks” was one of our ethnographic research guidelines: the parallel evolution of many investors making up their own strategies of investing in companies alongside grants looks like hacks to me.

What we need is a mechanism that enables biotechnology to continue growing despite fluctuations of short-term markets. We want a scalable funding and management system that grows the talent along with the technology, led by credible operators with relevant expertise, with constant encouragement for small teams to tackle big problems. There must be accountability in the short term but supportiveness to progress in the long term. Scale comes from a repeatable structure that incentivizes talent and holds everyone accountable to good behavior. Even when functioning perfectly, universities satisfied some but not all of the desiderata, but academia is progressively becoming a harder place to do good research.

Universities are sick and getting sicker. The undergraduate numbers tell a powerful story: US colleges are closing at a rate of one a week (going from 4,599 degree-granting in 2010 to 3,932 in 2021), meaning there is a growing hole for training the next generation of talent. Dropping enrollment is also indicative of university leadership failing to create value for the students: for example, I can’t see how $92,167/yr at Tufts University is worth it. So while I focus on pricing and prosecuting biotechnology research, I feel the urgency to find our next winning recipe to train a talented and empowered workforce.

The fieldbuilding dollars for SynBio/Biotech can’t just go to universities and Ginkgo anymore.

Step One: Agree on Problems that must be solved

Let’s say we create the ARAF, a billion-dollar pile of cash to be deployed into the US innovation ecosystem. Where does it go?

We know that capital must be focused in order to create progress. Without structure, entropy takes over and while the ecosystem might heat up for a bit, little forward momentum is generated. Capital deployed on themes alone is likely to have little effect – aka “Climate Emergency!” or “Web3.0” – whereas thesis-driven investment can outperform if the team is good enough. Creating a progress movement centered around major problems is a great way to structure the capital deployment.

We must create a problem-centric culture at the national scale. Over the past year, Homeworld has been quietly developing its Problem Statement Repository, and in our first blog announcement we reference the leadership of Heilmeier (DARPA) and Hamming (Bell Labs) who created much of our modern language about tackling problems. Homeworld’s thesis is that a broader discussion of problems is the first step to creating substantial solutions, and our progress at Homeworld confirms my hunch that problems are the correct battleflag for an ecosystem to rally around.

The fields that have been growing most –AI and genetic engineering– rarely talk explicitly about problems because good problems are so implicit in how those fields operate. If you see the Mistral Large 2 announcement, two days after the Meta Llama 3.1 announcement, you see that they are implicitly talking about solving the same problems, measured by the same benchmarks. For fields like biology, which is less linked to benchmarks, it takes a bit of extra work to explicitly state key problems.

So the first step is to use our existing expertise network to find the themes (climate biotech, quantum engineering, artificial intelligence, green chemistry ec), then unpack them into problems. The ontology might look something like:

Theme: Neuroscience

Problem: How to achieve whole-brain connectomics at synaptic resolution in mammalian brains

Problem: How to scalably access neuronal dynamics in living brain

Subproblem: Develop minimally invasive nanoelectrode arrays for high-density neural recording

Problem: How to discover universal principles of crossing the blood-brain barrier?

Theme: Climate Biotech

Problem: How to engineer nitrogen-fixing symbioses in non-leguminous crops?

Problem: How to develop bioengineered consortia for efficient bioremediation of heavy metal contamination in abandoned mines?

Problem: How to scale up cell-free biomanufacturing for sustainable production of high-value compounds?

(Note: These are purely meant to be illustrative)

After we build agreement on big problems in a few themes, teams will start proposing solutions. Now we need a way to fund those different teams. Capital needs a “growth curve” as some sort of model of expectations across time. Surely we can do better than the status quo of academia and startups.

Step Two: Create a New Growth Curve

Right now, every visionary scientist is forced into either academia or startups. These are the only repeatable methods we have1. This is a duopoly and the harm is that many great talents are robbed of agency or get locked into malformed startups. The benefits of creating more paths is that a whole latent class of talent, the scientist-founder, can be unlocked.

Developing the Problem-Centric Founder

Every startup has to immediately tell an exponential growth story. If there isn’t a exponential story, then that science has to be done in a university or subsist off government grants and contracts. This is a status quo with significant room for improvement: If we want funding allocators to invest in teams that tackle science risk, as opposed to market risk or technology risk, it means creating and disseminating an alternative growth curve that funding allocators can understand.

The practice of selectively funding teams with an exponential growth model is only fifty years old but has deployed over a trillion dollars in the US in the past five years alone (statista). This is the venture capital industry and it operateswith just 5,000-10,000 people (link). Exponential growth – and its corresponding dreams of billions– is why a few venture capital firms have yielded staggering results. It is also why the vast majority fail to breakeven. But as I’d explored in the Problem-Centric Founder essay, the exponential assumption just doesn’t make sense when the entire startup depends on science that is fundamentally unpredictable.

What we need is a precursor to the exponential growth curve. We need something that captures a step function of pre- and post- scientific risk. The sigmoid, famous for its use in machine learning to map a system’s output into a binary “go” or “no-go” value, is appropriate here. In Developing the Problem-Centric Founder, I shared our experience as non-profit founders at Homeworld. We are a fieldbuildign organization, not necessarily embarking on one single scientific endeavor, but I believe our experience generalizes well.

The intuition behind the sigmoid curve is that the primary science risk must be tackled before making assumptions on the future trajectory. In this model, there are three possible outcomes:

If the science doesn’t work on your given timeline, just open source what you have and move on with your life. Ditto if the result is good but not great. The faster, the better! Let’s count this as a true negative and make sure everybody grows from it.

If the science creates an important result but still can’t fit on the exponential curve, then find a non-profit framing that would support the problem at some informed baseline of needed funds. Re-raising ARAF funds on another sigmoid with a new science-risk target is a fine outcome.

If the science works out and has potential to work as a startup, raise investment and charge forward.

Let me emphasize the celebration of true negatives, as Bell Labs effectively did this model a century ago. In The Idea Factory, you’ll read that the organization’s spirit was to consider true negatives a form of success: The people in a valiant but failed project would recycle into other teams while they ponder on their next project. Today we have a beautiful ecosystem of startups and startup supporters that give credit to founders for trying a company that fails, but the knowledge tends to be lost. The ideal is to recreate this Bell Labs energy that recycles and shares the WHY behind the true negative outcome, but across the larger science community.

So how do you craft a sigmoid growth function for a science-centric team? Easy: The exact same way investors today work with teams to craft their exponential growth functions.

Step Three: Leverage gold-standard existing investment practices

Venture Capitalists (VCs) and non-profit Fieldbuilders are well positioned to be the groups that the ARAF empowers to find and support the teams tackling science risk.

I am not here to fawn on VCs. In general, they do that for themselves just fine. But we have to appreciate that the best venture capitalists have been catalytic to technology and talent development.

Part of a good VC’s job is to help the founder craft meaningful milestones to a startup’s growth. This is a true value-add service, especially when the investor is actively engaged with helping navigate the startup through actually accomplishing those milestones. Crafting a good inflection point on a sigmoid is, in principle, just like any milestone: it requires executive and technical expertise to frame an achievable and valuable goal. When evaluating whether to invest or not, the good venture capitalists will write memos of their investment decision. Science could benefit from the practice of memo writing.

Bessemer Venture Partners does an exemplary job of sharing their portfolio (and comical anti-portfolio) investment memos. Writing these memos is done for accountability to the limited partners of the VC firm to explain the what and the why of the investment decisions (more examples here).

The practice of rigorous memo writing and investment committee meetings feels fully applicable to deploying scientific grants. As with everything, the challenge is in the implementation.

Step Four: Open the ARAF competition and let anybody apply

We now have the structure of the science (themes/problems/solutions), a funding structure per team (the sigmoid) and the reporting for assessing teams to receive funding (the VC memo). The last step is to fund the funders.

Anybody can apply to be an allocator for the billion-dollar Applied Research Acceleration Fund. Here are some possible terms.

Fees: The ARAF will pay the standard VC management fees of 2%.

Limitations on investable targets: The ARAF funds under management must be relevant to the Priority Problems. Also, funds cannot go to existing for-profit companies.

Reporting: An ARAF deployment of capital requires an investor memo explaining the addressed Priority Problem, the science risk undertaken by the team and the inflection point that the ARAF allocators believe can be addressed with the given funding.

Non-exclusivity: If the ARAF Allocator is an investor in companies, ARAF funding must precede any venture investment in the team, and the investor deploying ARAF makes no formal claim on exclusivity of funding rights into the team. Put simply, the ARAF funding is an opportunity to build relationships, not lock in talent.

Allocator Expertise: The ARAF Allocator must demonstrate domain expertise relevant to the list of priority problems by the ARAF fund. Expertise in scaling technology into successful companies is an advantage but not a requirement.

Follow-on: A grantee of ARAF funding can receive a follow-on ARAF, but would require a new diligence memo explaining why the new milestone is a fit for the ARAF program.

Assessment: ARAF Allocators will be evaluated on the quality of their analyses and performance of grantees. Note that discovering and publishing a true negative is considered an honorable win. An ARAF allocator which has a 100% success rate in turning grantees into companies wouldn’t necessarily look good.

Venture Capital funds would naturally be advantaged in competing for this, but they would now face viable competition in a post-ARAF world as the fieldbuilding orgs develop. We are in a high-growth era for problem-focused research non-profits. Consider a few examples since 2020:

Fast Grants deployed $50M for covid research.

Impetus Grants deployed $26M for longevity research.

Unitary Fund has given away more than 100 microgrants for quantum technology.

Spark Climate has done multlipe rounds of grants for mitigating methane.

Homeworld Collective has deployed $1.3M for climate biotech research.

All of these organizations leverage their reputation and expertise to be good allocators of capital within their domains. They were also done with shockingly small teams of 2-10 problem-focused people empowered by philanthropy. I believe the experiments into fieldbuilding organizations, initially funded by philanthropy, are now ready for government funds.

Conclusion: Major shifts in funding philosophy have happened before and must happen again

An important but forgotten fact of Silicon Valley is that the first LP investment into a VC fund was a university. Traditional money managers in New York balked at the idea that a fund would invest in small teams pitching ideas from fancy slideshows. But in 1978, the Stanford Endowment invested in Sequoia Capital. It took the perspective of funding allocators sitting inside a university to see the synergy with a firm that might one day take an interest in Stanford graduates. Besides being an excellent financial result for the Stanford endowment (eg, investments to Apple 1978 and to Cisco in 1987), this had a fantastic cultural impact on the Stanford community: 50 years later, Stanford is the best university in the world for startups.

Analogous to Stanford’s incentives to invest in Sequoia down the street, governments have reason to invest locally, too. In 1978, the same year Stanford Endowment funded Sequoia Capital, the Commonwealth of Massachusetts established Massachusetts Technology Development Corporation (MTDC), now known as MassVentures. This initiative began with a $2 million appropriation from the state legislature, creating an evergreen fund that has been operating for over 45 years. MassVentures has since invested in over 150 companies, creating thousands of jobs and generating significant returns for the state. At the federal level, we're seeing innovative programs like the National Science Foundation's EArly-concept Grants for Exploratory Research (EAGER), which provides up to $300,000 for high-risk, high-reward research, and the NSF Regional Innovation Engines program, which aims to advance critical technologies and address national challenges through regional coalitions. Additionally, in October 2022, the bipartisan CHIPS and Science Act authorized the creation of the Foundation for Energy Security and Innovation (FESI), a private non-profit designed to channel private-sector investments into Department of Energy priorities. These examples demonstrate a growing recognition of the need for more flexible, venture-like funding mechanisms in the public sector to drive innovation.

So an ARAF is becoming more doable by the day. I argue that we need to take this weird idea seriously because the status quo is weaker than we think it is. PhD students are waking up to the fact that they’re being trained for professorship jobs that don’t exist. It would be a pity to lose our progress in biotechnology because our best microbial engineers can only get jobs screening cancer drugs. We depend on catalytic government funding but we can’t be bottlenecked on procurement limitations and recruitment of Program Managers.

The economy has changed a lot since the US Government started funding cutting-edge science in the era of Vannevar Bush. When DARPA was created in 1958, the salary of the US Treasury Secretary was $25,000 ($250,000 in 2024 dollars), which was both a higher salary and far more prestigious role than any comparable job on Wall Street. Today, the US Treasury Secretary Yellen ($221,400 in 2023) earns 1/100th the salary of David Solomon ($25M in 2023) as the CEO of Goldman Sachs. This is of course an extreme example of a government-to-industry comparison, but I bet a DARPA salary was upper echelon in the 60s and 70s. Government deployment of capital does not scale well if it’s gated on recruiting talent that is no longer maximally incentivized.

So I think the solution is not to create bigger institutions or to pack more into existing universities. Instead, I think it’s better to pick the important goalposts and empower the community of innovators to self-organize to take their best shots. These teams are already out there today, supported by philanthropy to test their models for encouraging innovation, and now I think we can say these models work.

So if the Western world says we value freedom, autonomy and incentives, we need to look to where we’ve been most successful. Our strengths today are not in creating large bureaucracies, our strengths are creating environments for which small teams are incentivized to grow into big teams. A “fund-of-funds” funding philosophy from the US government to fund fieldbuilders/VCs to then fund small teams to do cutting-edge research is just crazy enough to work.

Acknowledgments/Inspiration

Paul Reginato and the Homeworld Team

Niko McCarty for constantly helping me grow as a writer and detailed feedback on this piece.

Nazish Jeffery for sending great feedback and questions

Mike Fisher’s BAPO piece on Day One, specifically his BAPO Ventures concept.

Ben Reinhardt and SpecTech

David Lang and Experiment

Isha Data and New Harvest

Martin Borch Jensen and Norn Group

Jason Crawford and Roots of Progress

Braden Tierney and the Two Frontiers Project

Dom Falcao and Deep Science Ventures

Derek Thompson’s writing at the Atlantic

Michael Nielson and Kanjun Qiu’s monster metascience piece

Adam Mastroianni’s essay on The Rise and Fall of Peer Review, which questions a sacred foundation of modern science. It is a great reminder that our status quo is far from optimal.

Seeing like a State, by a recommendation in one of Tom Kalil’s interviews. The first half does a great job telling the stories of top-down failures of management. Specifically, the juxtaposition of Jane Jacobs’ study of cities by walking the alleyways versus Le Corbusier’s city architecture strategy of flying over the space is an apt metaphor.

Juan Benet’s talk on Decentralized Investment Structures in 2022. I think this is a great talk arguing for the value of expert intermediaries when allocating funding in complex spaces. My takeaway is that there is an upper bound of how many grants a single team can make, so we can learn from the hierarchical funding structures of the private markets to fund science better.

Using GlassDoor’s reviews for this company’s news, there doesn’t seem to be a public announcement yet.

Pretty funny timing here given this is almost comically the grown-up, harder numbers, more actionable version of the piece I published today. Love the idea and the points brought up throughout, examples like Stanford investing in Sequoia are of such foresight it is almost mind-blowing, especially in hindsight knowing the returns now. Stanford's singular greatest triumph as an institution may well be its remarkable intuition, when facts like this are placed in conjunction with their setting aside of large swathes of land, now immensely valuable, for parks and nature preserves. Separately, what immediately popped into my head when you were discussing long term investment is ironically luxury fashion brands, the LVMH owner has consistently said they should not focus on year-to-year profits or statistics because they need to be focused on building something timeless that has and will last centuries. Completely different ballpark, but some interesting overlaps with biotech!